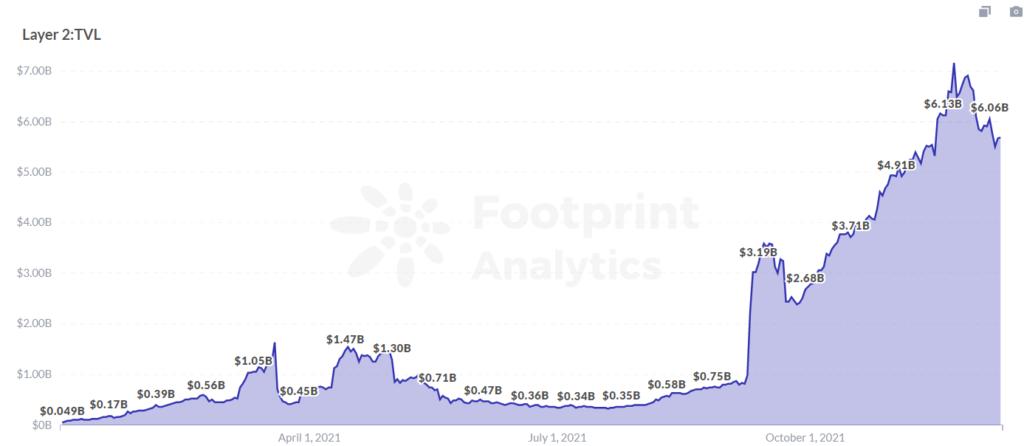

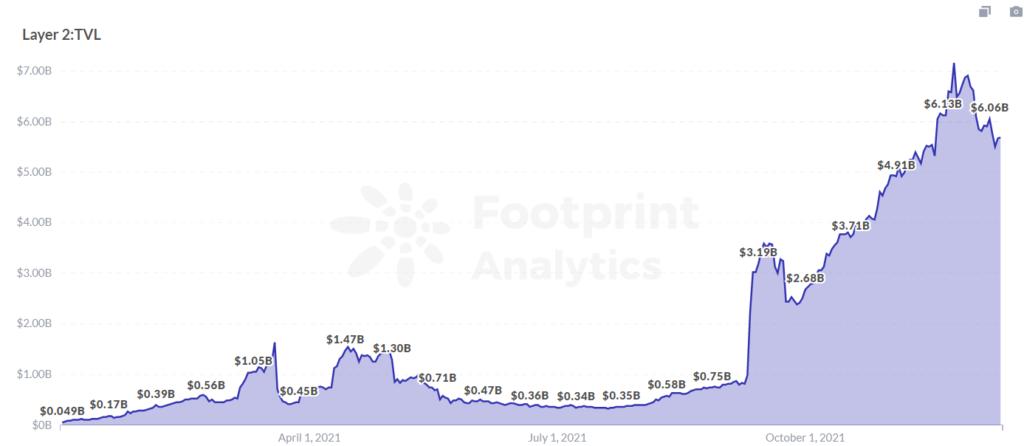

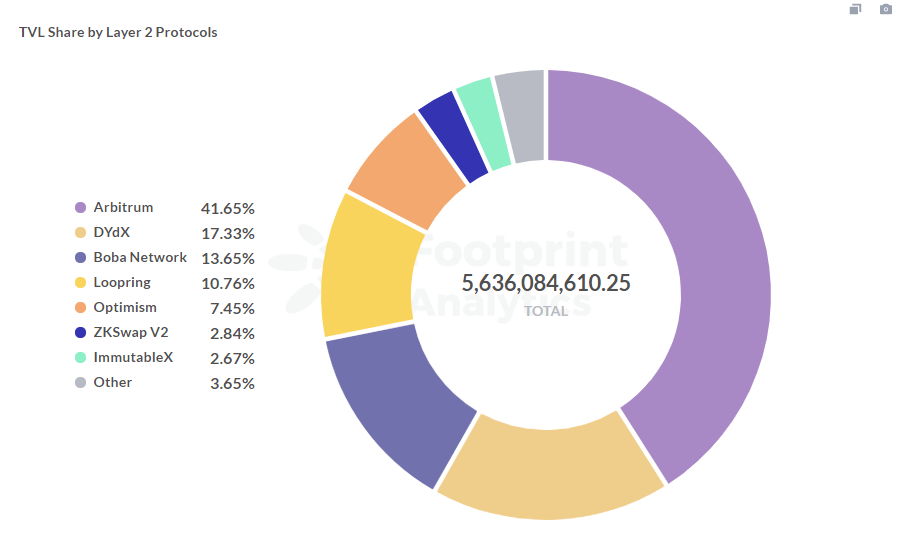

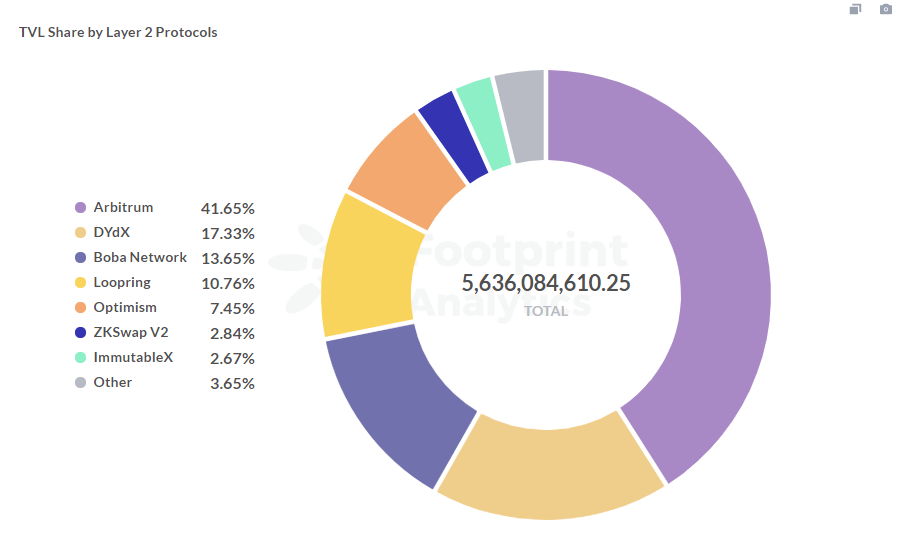

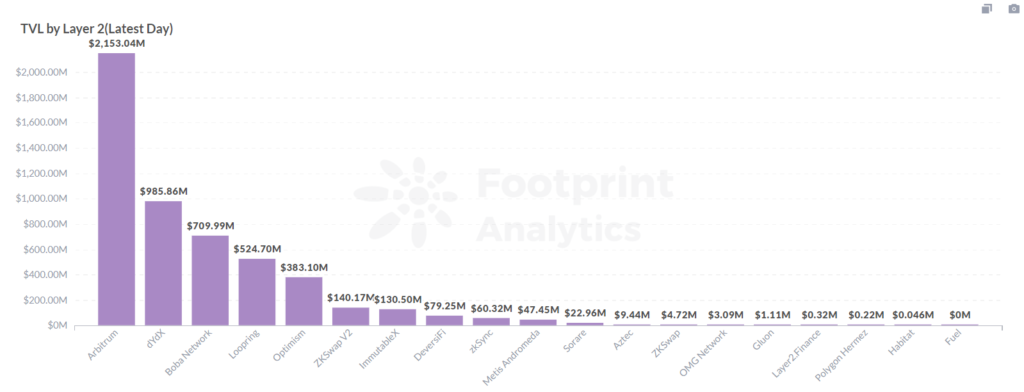

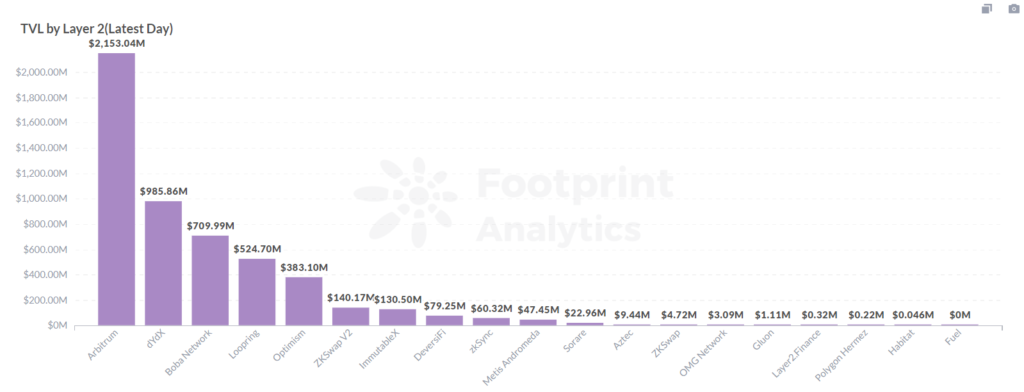

The TVL of Ethereum Layer 2 projects increased 600% from Q3 to Q4, surpassing a peak of $7.17 billion on Nov. 25. The highest TVL as of Dec. 11 was Arbitrum ($2.4 billion), followed by dYdX ($980 million), with Boba Network in third, with a TVL of $770 million.

As the number of users on Ethereum grows, network congestion and high gas fees are becoming a primary problem for applications. As the demand for Ethereum increases, alleviating the problem has become a top priority. Vitalik Buterin presented “A rollup-centric Ethereum roadmap” at a conference on Oct. 26, implying that Layer 2 is the future of Ethereum scaling.

What is Layer 2?

The purpose of layers is to relieve pressure by expanding the Ethereum network’s capacity. Layer 2 is a scaling solution that builds and improves upon Layer 1.

- Layer 1: Improvements to the blockchain itself to improve capabilities, e.g. on-chain scaling, consisting of solutions that increase block size or data structure, sharding techniques and segregated witness to achieve increased transaction processing capacity.

- Layer 2: Instead of directly changing the block size and other rules of Layer 1 (the mainnet), a second layer under the chain (i.e. Layer 2) is built, including state channels, sidechains, Plasma and Rollup, where some transactions are processed to share the pressure of the mainnet and interact with it when necessary, i.e. off-chain scaling.

What is the connection between Layer 1 and Layer 2? They are like the relationship between the parent company and the subsidiary company. The main core technical point of Layer 2 is to transfer some transaction data requests on Ethereum to Layer 2 for processing. After processing, Layer 2 returns the transaction information across the chain to Layer 1 to reduce the pressure of transactions on Layer 1 and achieve low gas fee transaction results.

In addition to this, Layer 2 is an extension to Layer 1, breaking away from the limitations of Layer 1’s original functionality and inheriting the security of Ethereum without compromising Layer 1’s own features.

Scaling solutions of Layer 2

The early days of Layer 2 saw two main approaches — state channels and side chains. However, Layer 2 developers have found that state channels could not be decentralized and anonymity was needed for privacy protection, and sidechains hold the control of the assets off-chain, which was a big concern for asset security. Hence, neither were ideal for scaling in Layer 2.

A good solution is one that maintains the security of data, the authenticity and anonymity of transactions, and short exit cycles, and Layer 2 has taken advantage of these features to continuously improve its expansion capabilities.

According to Footprint Analytics, there are currently 19 projects in Layer 2, including DEX types and other networks. They remain the most noteworthy trends in the crypto sector, with total TVL up 11,400% from the beginning of the year to date. Layer 2’s rapid growth is directly related to its scaling technology solutions, and there are currently four main scaling solutions: Plasma, Optimistic Rollup, ZK Rollup and Validium.

1. Plasma secures assets, but information unavailability is a barrier

Plasma is an off-chain scaling solution that relies on the mainnet interacting with the least amount of off-chain transactions, and it uses child chains reporting to the root chain (i.e. Ethereum) to improve transaction throughput (the number of requests the system can process per unit of time).

Plasma is one of the first Ethereum scaling projects from OMGX Network to come up with the Layer 2 concept, which works on the following principles.

- First build the Plasma chain outside of Ethereum and users transfer assets from Ethereum to the Plasma chain, a process that requires the mainnet assets to be sent to a smart contract that manages the Plasma chain. That asset can then be accessed for interaction.

- At regular intervals, the Plasma chain operator (i.e. the Plasma chain maintainer) will batch the transactions within that time period to generate a block.

- The Plasma chain operator returns the result of the calculation to the mainnet and sends the status of the asset transaction to the current owner of the asset.

The breakthrough point of the Plasma chain scaling solution is that it guarantees the relative safety of the assets and the ability to extract transaction results on the mainnet even when the off-chain environment is unavailable. Thus, it increases the mainnet transaction throughput and reduces the interaction with the mainnet while lowering the transaction gas fee.

However, the Plasma mechanism is not perfect.

- Data is not available. The master chain does not have access to all off-chain data and can only be simply verified by means of a root hash (a typical binary tree structure consisting of a root node, a set of intermediate nodes and a set of leaf nodes.)

- Long withdrawal cycle. Complicated exit mechanism due to non-availability of mainnet data, requiring longer lead times for fraud proofs, resulting in longer withdrawal cycles of approximately 7 to 14 days or more.

- Generic extensions are difficult. Restricting the data structure of sub-chains in a technical framework increases the difficulty.

Plasma project: OMG Network

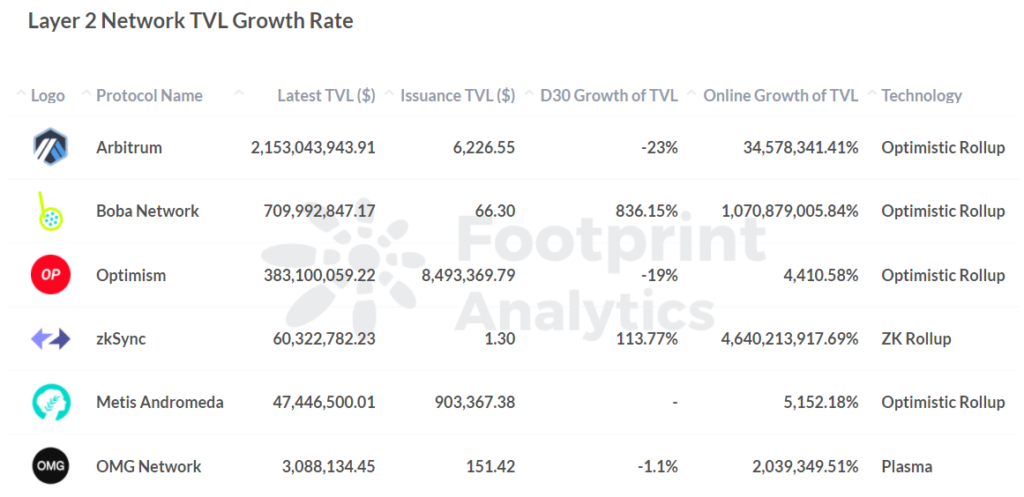

According to Footprint Analytics, the current TVL for OMG Network is $3.1 million, placing it at #14 among Layer 2 projects, which is small compared to other projects and, in terms of trends, a stagnant project.

However, with the emergence of new solutions such as Optimistic Rollup in Layer 2 Projects, the above problems of Plasma have gradually weakened the potentials of OMG Network. Hence, it has upgraded its brand to Boba Network using Optimistic Rollup scaling solutions to get more opportunities to grow.

Optimistic Rollup and ZK Rollup fundamentally solve the problem of unavailability of Plasma data.

2. Optimistic Rollup compresses on-chain transaction data

Optimistic Rollup is a combination of Optimistic contracts and on-chain data availability, choosing to trust the authenticity of transaction packages submitted by operators and penalizing fraud.

It operates on the principle that when Layer 2 calculates the result back to Layer 1, if the verifier believes the result may be fraudulent, then the verifier can initiate a challenge and the master chain freezes the asset and performs transaction data and record verification to prove whether it is a genuine or fraudulent transaction. Alternatively, if no validator doubts the result of the calculation, the master chain defaults the transaction to be genuine.

This model improves on-chain efficiency, packages multiple transactions for operation, saves time and saves gas fees, has stronger compatibility, reduces developer workload and better solves the pain point of Ethereum congestion.

Có thể bạn chưa biết, sàn giao dịch BingX đang có nhiều đặc quyền cho thành viên mới và thành viên VIP.

The disadvantages are:

- Inefficient validation. Validation of fraud proofs mechanisms resulting in long challenge periods for assets to be deposited and transferred out.

- Funds may be frozen. If the verifier believes the result is fraudulent, it is vulnerable to asset freezing by the master chain.

- Not as scalable as ZK Rollup. relatively low transaction compression.

Optimistic Rollup projects: Arbitrum and Boba Network

According to Footprint Analytics, the Arbitrum chain is currently the Layer 2 leader, while the Boba Network is an emerging network that has been growing rapidly in the last month. They use the Optimistic Rollup scaling solution, which enables high throughput and allows developers to deploy and operate smart contracts at low cost, while maintaining trust-free security.

3. ZK Rollup is highly decentralized but difficult to develop

ZK Rollups are designed to improve scalability by centralising a large number of funds transfers in a single transaction. Whereas Plasma creates one transaction each time a funds transfer occurs, ZK-Rollups bundle hundreds of transfers into a single transaction.

Compared to Optimistic Rollup, ZK Rollup has a higher transaction compression rate. This is reflected in the fact that it verifies the veracity of a transaction packet through zero-knowledge proofs, where the operator is able to convince the verifier that an assertion is correct without providing any useful information to the verifier. This is done as follows.

- User transfers in and locks assets and Layer 2 adds account asset information.

- In the Rollup network, users sign and send transactions.

- Operators collect transactions, package them in bulk and generate zero-knowledge proofs.

- The operator broadcasts the transaction package and zero proof of knowledge to the master chain.

- The smart contract verifies the authenticity of the transaction packet through zero-knowledge proofs, updates the values and performs the transfer operation.

The advantages are:

- Achieving decentralization

- High uplink efficiency

- Higher transaction compression rates

- High validation efficiency, and no validation waiting period

- Better security as well as privacy. Zero-Knowledge Proof does not reveal transaction details and ZK Rollup technology ensures that the data submitted to the master chain is authentic and valid.

The disadvantages are:

- The complexity of the process of generating zero-knowledge proofs.

- Application customization is difficult to develop and compatibility is low.

ZK Rollup project: dYdX

dYdX is building a robust and professional exchange for trading crypto assets so that users can actually own their trades and ultimately own the exchange itself.

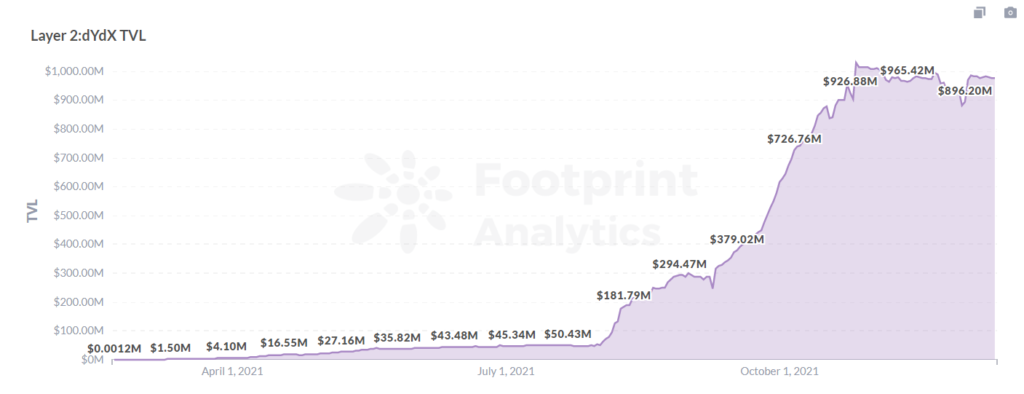

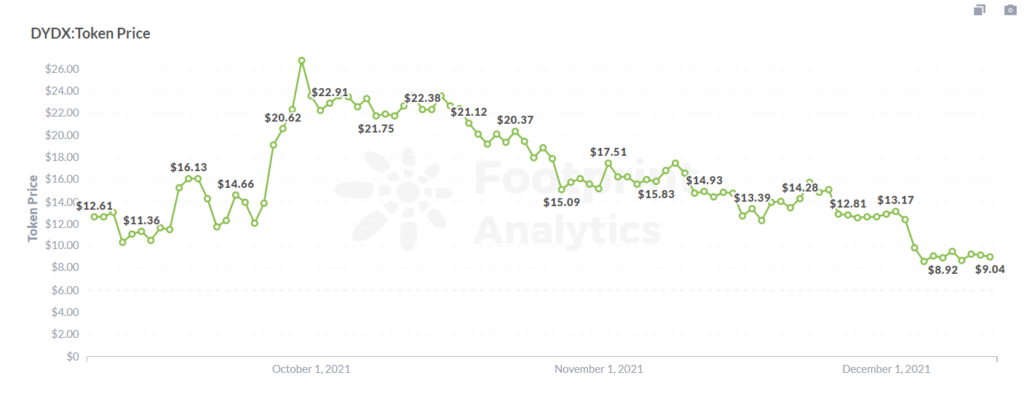

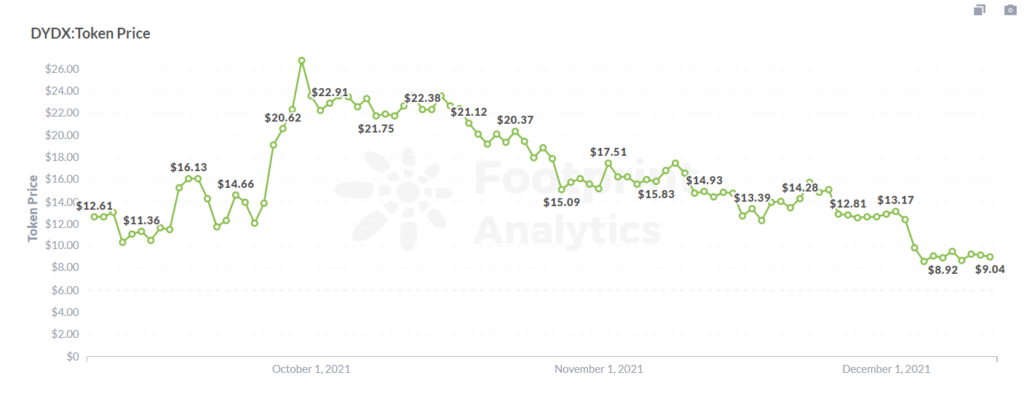

dYdX is a leading DeFi derivative and one of the earliest adopters of ZK Rollup technology. Overall data performance: Following the continued upward trend since August, TVL has held steady in the top 2 Layer 2 projects with a current TVL of US$976 million and a downward trend in its Token (DYDX) price, currently at US$9.04 with a market cap of US$570 million.

4. Validium is a hybrid scaling solution with low security

Validium is a hybrid scaling solution that enables users to choose between the ZK Rollup and Validium modes. However, unlike ZK Rollup, Validium’s data stays under the chain, while ZK Rollup’s data availability is on the chain.

Validium is probably better suited for applications that do not require as much trust (e.g. gaming DApps), while ZK Rollup is better suited for scenarios such as payments and exchanges that require more security.

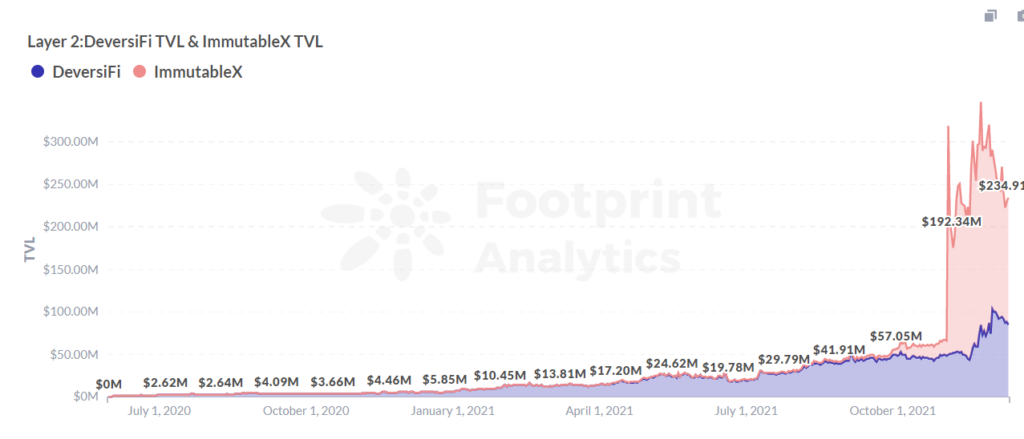

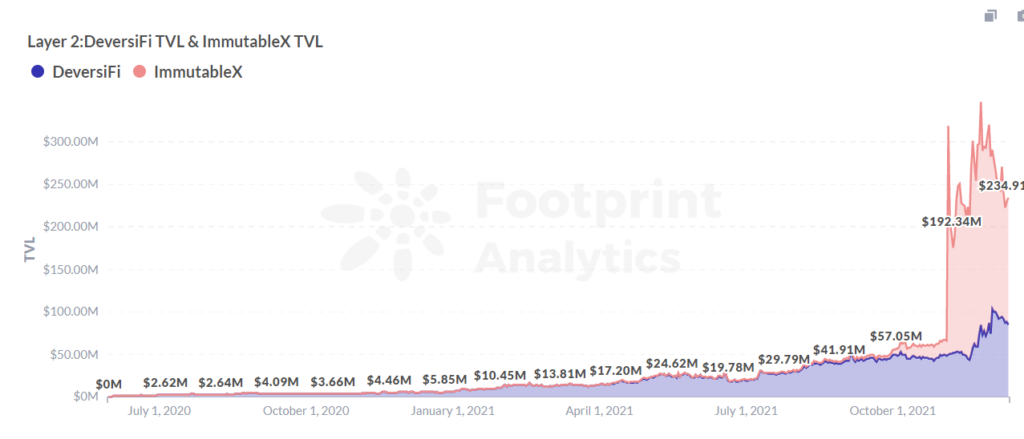

Validium projects: DeversiFi and ImmutableX

DeversiFi, which claims to be the easiest way to access DeFi opportunities on Etheruem: invest, trade and send tokens without paying gas fees, the largest current Validium-based decentralized exchange, surpassed a record high TVL of over 100 million on 4 December, according to Footprint Analytics.

ImmutableX, the first Layer 2 of NFT on Ethereum, promises zero-gas fees for games, apps, and marketplaces as well as instant transaction scalability. It currently sits at #7 in the Layer 2 rankings.

Summary

Layer 2 scaling solutions have been updated and iterated over the years to achieve a secure solution for scaling on Ethereum, alleviating problems such as congestion and high gas fees. They have become the mainstream technical solution for scaling applications of blockchain technology.

Layer 2’s technological innovation and rapid development is also driving the DeFi market, NFT and virtual worlds, among others. As network throughput improves and transactions become more efficient, Layer 2 will likely become the future of Ethereum scaling.

The above content is only a personal view, for reference and information only, and does not constitute investment advice. If there are obvious errors in understanding or data, feedback is welcome.

This work is the original work of the author, please indicate the source of reproduction. Commercial reproduction requires authorization from the author. Unauthorized commercial reproduction, excerpt or use in other ways will be investigated for relevant legal responsibilities.

This report was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.