The Earth Financial Forum (WEF) has introduced its most up-to-date report on “digital forex governance” this month, addressing stablecoins, cryptocurrencies, and “barriers to economical inclusion.” Like most central banks, regulators, assume tanks, and politicians, the WEF publication gives lip provider to the energy of crypto, but in no way addresses the elephant in the area: instead of genuine entry to the utility cryptocurrencies already freely present, the “unbanked” and impoverished men and women of the planet are forced to use a co-opted, fiat 2..

‘Financial Inclusion’ and ‘Sensible Regulation’: Flexibility for Me, Compliance for Thee

In accordance to the Planet Economic Forum’s November 2021 White Paper Sequence Report “What is the Value Proposition of Stablecoins for Monetary Inclusion”:

Economic inclusion is a intricate global problem that existing techniques

and offerings have so considerably unsuccessful to remedy.

Financial inclusion is not definitely that complex, but existing programs most undoubtedly are failures. The existing paradigm of centralized financial command and central financial institution fiat currency issuance has so considerably failed to support those who need to have economic liberty to endure and thrive the most. An admission from the horse’s mouth, then, if you will. In order to adjust these aged, damaged methods, the remedies introduced by politicians are often the similar: more of the specific very same economic dysfunction that designed the chaos in the 1st spot.

There’s no denying that obtain to dependable fiscal products and services and audio cash is an concern plaguing billions of people today on this planet. Considering the foundations of fiat currencies themselves, it can be rightly mentioned that the complete world wide inhabitants (aside from individuals few at the major of the Ponzi scheme fountain of coercive, centralized fractional reserve banking) suffers from a absence of accessibility to fair, secure, and audio monetary solutions, markets, and prospects.

The straightforward (and unfortunately, even now “controversial”) purpose for this is that there are finally two lessons of men and women: individuals who feel violence versus the non-violent is essential for economic get, and all those who value freedom and consent in markets. The uncomplicated alternative is to permit persons own their have cash and prevent robbing them with taxes and inflation.

The previous group of individuals (professional-violent economic interference) incessantly parrots the same traces when it will come to cryptocurrencies. It is the form of repetitive, broad-eyed propagandizing a person may possibly hope to listen to at a holy roller tent assembly, or in some fringe cult, but not from any amount-headed economist:

“Bitcoin is used largely for illicit routines and criminal offense.” Of course this is not only statistically false, but when compared to fiat currencies like the U.S. greenback, the condition is by and much the winner in the “funding-crime” competitiveness. This is prevalent knowledge by now, and so very well-documented just one is still left to conclude that both these regulators are blindingly silly, or lying.

“We need to foster an environment of rely on.” That is, believe in in the very identical money institutions and political entities that have continually — and over many years and generations — confirmed on their own to be untrustworthy and even destructive.

Then there is the blatant hypocrisy, also reminiscent of a cult, where by these perceived leaders give lip assistance to large humanitarian values and virtues, like “financial inclusion,” but under no circumstances stay them out in exercise, and in no way carry a finger to aid the weak.

U.S. Securities and Trade Fee (SEC) Chair Gary Gensler states that Satoshi “Nakamoto’s innovation is actual,” but proceeds to threaten businesses trying to offer providers by using that exact innovation, even breaking the SEC’s own lawful protocol to do so, applying really antiquated guidelines to this brand new financial paradigm.

Likewise, centralized exchanges and financial institutions kowtow to regulators, creating it unachievable for individuals who could after entry and trade crypto without the need of an ID, and without the need of risk of getting jailed, to enjoy the added benefits of the tech. This is particularly genuine for impoverished regions, which we will contact on under.

Even the most so-identified as progressive politicians and regulators, who make a present of standing towards cryptocurrency regulations they deem unfair, continue to simply cannot match the exquisite peer-to-peer simplicity explained in the Bitcoin whitepaper:

“A purely peer-to-peer version of digital cash would allow for on line payments to be despatched right from a single social gathering to another without having heading by a monetary institution.”

And they do not want to. Even to the most forward-thinking statist, there is a ruling course and a servant course. In India masses of people today are now waiting around on the choices of strangers in parliament to identify if and how they might use their own funds. It doesn’t make a difference if they approve of the final selection or not. Or if they aid the state. The law will be forcefully utilized to them below risk of violence. Exact in the U.S. Same in Europe. Identical everywhere you go. How really inclusive and revolutionary.

Buzzwords like “financial inclusion” and “banking the unbanked” are utilised, then, to co-decide a engineering that is by now useful and efficient and does not need violent interference from the condition.

Still, the weird prescription from central banking companies stays: Use central lender digital currencies (CBDCs) or pre-approved crypto from a state-accredited trade. You may perhaps do whatever you like in entire freedom, as extensive as we outline it.

Biggest Examples of Economic Ineptitude and Fiscal Criminal offense Dismissed

The WEF report raises two important factors in the part titled “Special features of stablecoins for financial inclusion.” Specifically, that “Stablecoins (and cryptocurrency) may perhaps aspect-move challenges associated to shopper mistrust in common economical providers,” and that they “may uniquely supply digital monetary accounts that malicious or untrustworthy actors cannot steal from.”

Evidently proponents of economic liberty, and Satoshi Nakamoto himself, have been aware of level two. That was the total position of bitcoin in the to start with position. There is no want for a reliable 3rd occasion to foul things up in one’s transactions anymore. Of study course, WEF manages to mangle even this easy place by qualifying the unparalleled stability and basic safety crypto brings:

That reported, for quite a few conclusion-customers currently, the general chance of dropping cash via person mistake, or through monetary or specialized difficulties with the digital forex issuer or wallet, is most likely to be larger with stablecoins (and cryptocurrency) than with accounts held at regulated financial establishments or companies.

This of training course ignores the broad array of non-custodial options that at present exist for backing up wallets, storing seeds and passwords, and even keeping crypto by means of joint wallets or sensible contracts that perform as a bank, without having the compromise in privacy and belief expected for legacy banking companies. And, if the issue is a chance of losing funds, possibly it is great to glimpse at the undisputed grand champions in the contest of shedding cash: governments. And that will guide us back again all over to the initially level raised by WEF. There is no need to have to mend have faith in with governments that will recklessly devalue and stifle belongings they drive people today to trade with. They really should most unquestionably under no circumstances be dependable.

As late, then-U.S. secretary of defense Donald Rumsfeld admitted about section of protection accounting programs in 2001:

Our economic units are a long time old. In accordance to some estimates, we are not able to observe $2.3 trillion in transactions. We simply cannot share details from floor to ground in this developing due to the fact it’s saved on dozens of technological devices that are inaccessible or incompatible.

If one thinks this centralized ineptitude and inefficiency doesn’t implement to central banking and treasury programs as properly, a single would be mistaken. Certainly, printing trillions of bucks from slim air to shore up an financial state wrecked by the very same reckless guidelines is a fool’s video game — and literal counterfeiting rip-off — but outside of that, there’s plenty of evidence blind rely on equates to disaster.

Mexico’s banking process, as a a single-off illustration, “misplaced” at least $18 million in transfers back again in 2018, bringing time-sensitive transactions to a standstill. What’s more, the world’s most significant and most trusted names in banking like JPMorgan, Deutsche Financial institution, Chase, and some others are frequently tied to felony activity like income laundering, and even drug and intercourse trafficking.

All this in watch, it is unclear why any sane current market actor would trust the exact establishments any more, exactly where there is a greater solution, and wherever stability, buy, and governance are nonetheless attainable, but dependent on verification and not have faith in — a amount taking part in industry developed by arithmetic and decentralized programs, not politicians.

Africa, a Key Example of Crypto’s Utility

In Africa, crypto’s simple utility is on screen by now, as individuals in nations like Zimbabwe, Nigeria, and Kenya leverage the seem economic rules and performance of private electronic property to maintain value and ship cross-border payments. Their own centralized fiat techniques have failed them immensely, and continue to do so.

In Nigeria, for case in point, as a substitute of seeking squarely at the fact of trade on parallel marketplaces, the central bank is arbitrarily assigning unrealistic, formal valuations to the fiat forex, shunning crypto customers, and pushing an IMF-involved CBDC recognised as the e-naira. If inclusion is genuinely the goal, it must be asked why central banking companies in these battling regions exclude the crypto sector and stifle innovation. In particular when it’s encouraging individuals in require to reside and thrive, correct now. As monetary assistance Kurepay’s CEO Abikure Tega not too long ago lamented:

Thanks to this latest clampdown which we come across hard to understand considering that Nigeria is not a lawless place, Kurepay, Africa’s foremost social payment application for cryptocurrency & fiat — is saying the suspension of small business operations in Nigeria.

Economic Governance Does Not Have to have a Point out

This article likely has some inquiring: “But who will make the principles?” To which I reply with the query: “Does every transaction you make in the crypto financial state, or on the blockchain, call for the oversight of centralized law enforcement to make it reputable?” The problem of non-public regulation societies centered on goal reality and consent — and not arbitrary statist violence — is a important just one, but is relatively over and above the scope of this composing. That said, crypto has presently shown us that organization can be accomplished a great deal a lot easier the place belief is not obligatory, and verification goes the two techniques — not just the serfs presenting their KYC papers to mysterious rulers in shadowy banking edifices.

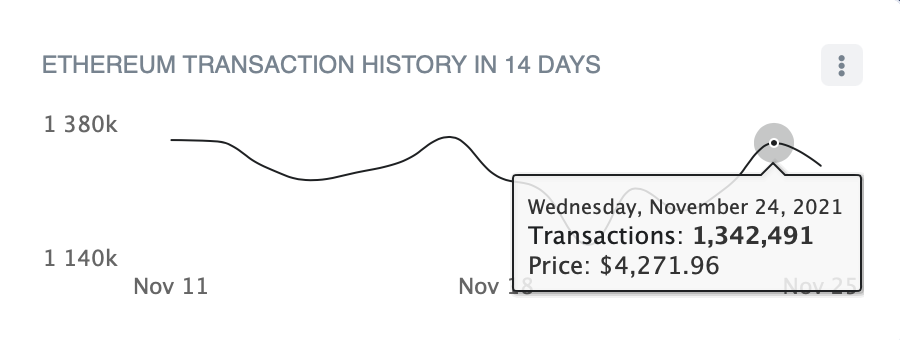

On November 24, there had been 1,342,491 ETH transactions in accordance to the Ethereum blockchain explorer etherscan.io. Retain in head this is only the ETH network, where by expenses are at present insanely superior and relocating tokens can be tricky. Imagine the staggering selection of transactions, then, that arise throughout all of the decentralized finance (defi) landscape day by day. Even though there are cons, most of these transactions are prosperous and tranquil, with no centralized oversight. This is mainly because each day people wish to trade, realize success, and cooperate. And the complexity of this decentralized economic system is mind-boggling.

Crypto is mentioned to be total of scammers and challenges. Though that could be genuine, it doesn’t start off to assess to the biggest rug-pull of all time — hands-down — which is when the point out took the power of cash from the particular person. Central banking companies suffer pretty much no consequence for fraud, theft, or damages. The paycheck is confirmed from your taxes. Compared with that cafe on the corner, which if they poisoned an individual would deal with significant market place implications, the state has built itself the current market, and the arbiter of justice, albeit an synthetic and violent a person. Blockchain, having said that, is just math, and sound economics presents no quarter to wacky religions, which is why regulators dread points like bitcoin, and will have to resort to violence.

Close to the earth, central financial institutions, fiscal regulators, and consider tanks are aping the exact mantras from their ivory towers to the having difficulties masses: “We are functioning for you.” “We want all people to have access to these innovative fiscal methods and options.” But what they do is make the options crypto provides possibly difficult to proficiently obtain, or outright unlawful.

The real truth of the subject is fairly easy. This is not about financial planners rallying behind monetary inclusion. Somewhat, it is just the reverse. The self-appointed leaders of the dinosaur devices and institutions of the globe are petrified because individuals are now waking up to new opportunities in income through crypto, and they know quickly they may possibly be economically irrelevant, by themselves entirely excluded from the new, freer paradigm staying constructed.

What are your thoughts on fiscal inclusion? Let us know in the remarks segment down below.

(function(d, s, id)

var js, fjs = d.getElementsByTagName(s)[0]

if (d.getElementById(id)) return

js = d.createElement(s) js.id = id

js.src=”https://hook up.facebook.internet/en_US/sdk.js#xfbml=1&variation=v3.2″

fjs.parentNode.insertBefore(js, fjs)

(document, ‘script’, ‘facebook-jssdk’)) .