Analysts predict a probable fall to $46,000 for BTC in the short-expression prior to it resumes its uptrend which could see its price tag rise to $60,000 by the close of January.

Sector Update

The bearish pressures dealing with the cryptocurrency industry at the close of 2021 have ongoing into the to start with week of 2022 right after the selling price of Bitcoin (BTC) dropped under $47,000 on Jan. 1 and the asset still faces stiff headwinds on the shorter timeframe charts.

Info from Cointelegraph Marketplaces Pro and TradingView exhibits that, right after climbing higher than $47,500 to start off the new 12 months, the value of BTC fell underneath stress in the afternoon on Monday. Now, the price tag has dropped to $46,500 exactly where bulls now glance to mount a protection.

Here’s a search at what quite a few analysts in the market are indicating about the path forward for Bitcoin in 2022 as the world wide financial program continues to grapple with inflation.

BTC requirements to reclaim help at $48,670

Evaluation of the weekly price functionality for BTC was resolved by crypto trader and pseudonymous Twitter user ‘Rekt Capital’, who posted the subsequent chart highlighting the main guidance and resistance place at $48,670.

As revealed in the higher than chart, “BTC has properly retested the black diagonal as support” according to Rekt Cash, and “has been executing so for a few months straight.”

The weak spot to start out the yr has positioned BTC below the established assistance zone highlighted by the red horizontal line. Rekt Cash sees this as a possible focus on to hold an eye on in the around phrase.

Rekt Funds mentioned,

“However, current weekly close usually means that the red horizontal (~$48,670) has been lost as assistance. BTC could bounce quickly in an effort to reclaim pink as support.”

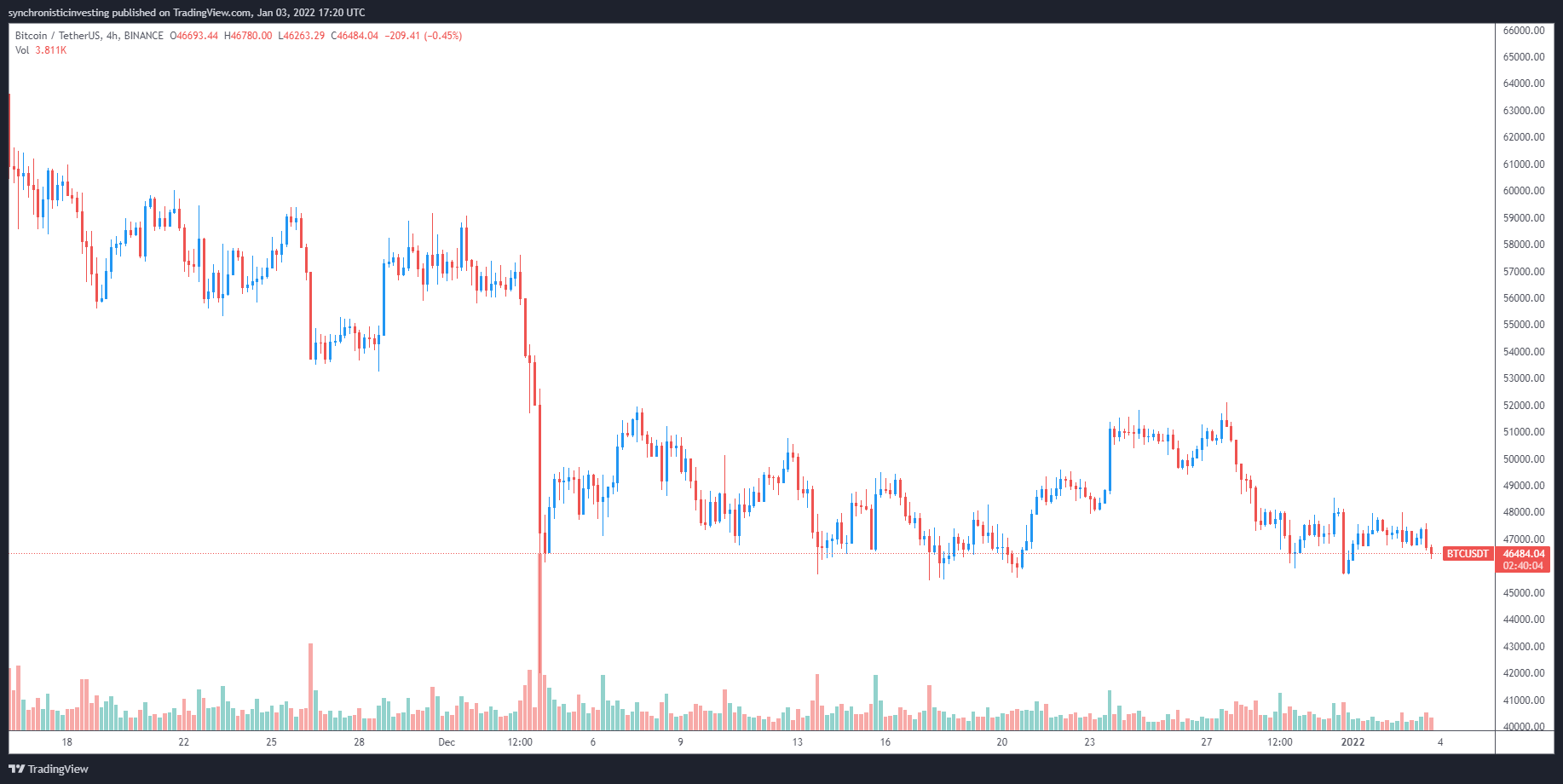

Search out for $46,000 in the shorter phrase

The latest weak spot for BTC was also addressed by analyst and Cointelegraph contributor Michaël van de Poppe, who posted the pursuing tweet that implies that the rejection at $48,000 could direct the value to slide underneath $46,000.

#Bitcoin rejected at the $48K amount, through which it is continue to trying to get aid to be strike.

Hunting at the area at $46K. pic.twitter.com/z0v88Ls58v

— Michaël van de Poppe (@CryptoMichNL) January 3, 2022

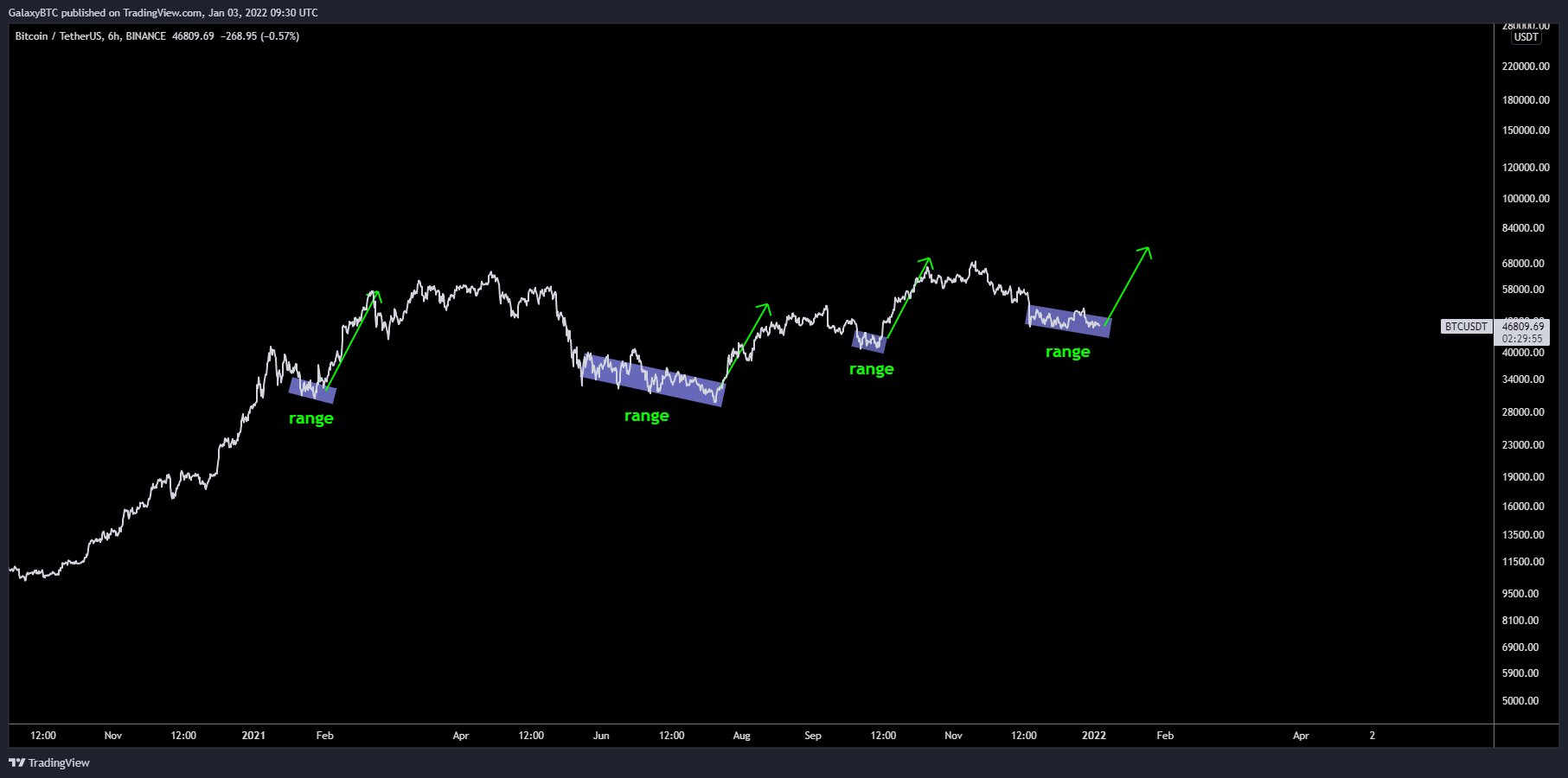

Even with the limited-time period struggles for Bitcoin, the prolonged-time period outlook proceeds to appear bullish for numerous buyers. Between them consists of analyst and pseudonymous Twitter consumer ‘GalaxyBTC’, who posted the next chart outlining a achievable breakout in Q1 of 2022.

GalaxyBTC mentioned,

“It’s just a make a difference of time in advance of BTC breaks out, and the for a longer time it takes the harder it will pump. Q1 is up only.”

Associated: Bitcoin is new gold for millennials, Wharton finance professor claims

Bullish cup and take care of development hints at moon by March

This good foreseeable future outlook for BTC expressed by GalaxyBTC was echoed by crypto trader and pseudonymous Twitter user ‘Bobby Axlerod’, who posted the following chart outlining the predicted trajectory of a cup and handle formation on the Bitcoin chart in the months forward.

Bobby Axelrod said,

“The “HANDLE” will conclude up looking a thing like this imo: $58,000-$60,000k mid to late January a pullback to $48,000-$50,000 1st 7 days of February Retest ATH stop of February or extremely early March Tiny pullback early March, then rocket.”

The overall cryptocurrency sector cap now stands at $2.234 trillion and Bitcoin’s dominance rate is 39.6%.

![UNI tăng 11% sau loạt diễn biến mới, còn tăng cao hơn không? - Tin Tức Bitcoin - Cập Nhật Tin Tức Coin Mới Nhất 24/7 2025 Bạn là chuyên gia SEO tiền điện tử. Dựa trên TIÊU ĐỀ GỐC = “Uniswap rallies 11% after 3 developments – Can UNI push higher?” hãy viết lại 1 tiêu đề Tiếng Việt tối đa 68 ký tự, bám sát ý CHÍNH quan trọng nhất trong nội dung gốc (được phép lược bỏ chi tiết phụ và đổi thứ tự các vế cho tự nhiên), không thêm dữ liệu hay chi tiết mới, dịch/viết lại thật tự nhiên. Nếu là câu hỏi thì giữ nguyên ý nghĩa câu hỏi và dấu “?”. Cố gắng xác định rõ tác nhân (Người…/Nhà đầu tư…/Công ty…/Cá voi… khi phù hợp), chọn 1 chủ thể trọng tâm thay vì liệt kê quá nhiều vế, giọng khách quan như báo tài chính, không khuyến nghị mua/bán. Ưu tiên cấu trúc [Tác nhân] + [Hành động mạnh] + [Bối cảnh giá/thời điểm/dự báo]. Chuẩn hóa số liệu theo chuẩn Việt Nam: dùng “,” cho thập phân, “.” cho hàng nghìn, bỏ phần thập phân nếu =0, rút gọn số chỉ còn 1 chữ số thập phân, đổi “$” thành USD (ví dụ: 100 USD), 1M → 1 triệu, 1B → 1 tỷ, 1T → 1 nghìn tỷ. Tự động đổi thời gian UTC → GMT+7 nếu xuất hiện(Ví dụ: 13:00 (UTC) sẽ chuyển đổi thành 20:00 (giờ VN)). Không dùng ngoặc kép trong tiêu đề, không tự tham chiếu, không ký tự thừa, tránh giật tít, tối ưu cho AI Search (Google AI Overview, SGE, Featured Snippet, PAA, Perplexity, ChatGPT Search).](https://tintucbitcoin.com/wp-content/uploads/2025/12/1766302191_Ban-la-chuyen-gia-SEO-tien-dien-tu-Dua-tren-120x86.png)