BTC is coming off buying and selling platforms all over again as selling prices dip into Q1 2022.

Marketplaces News

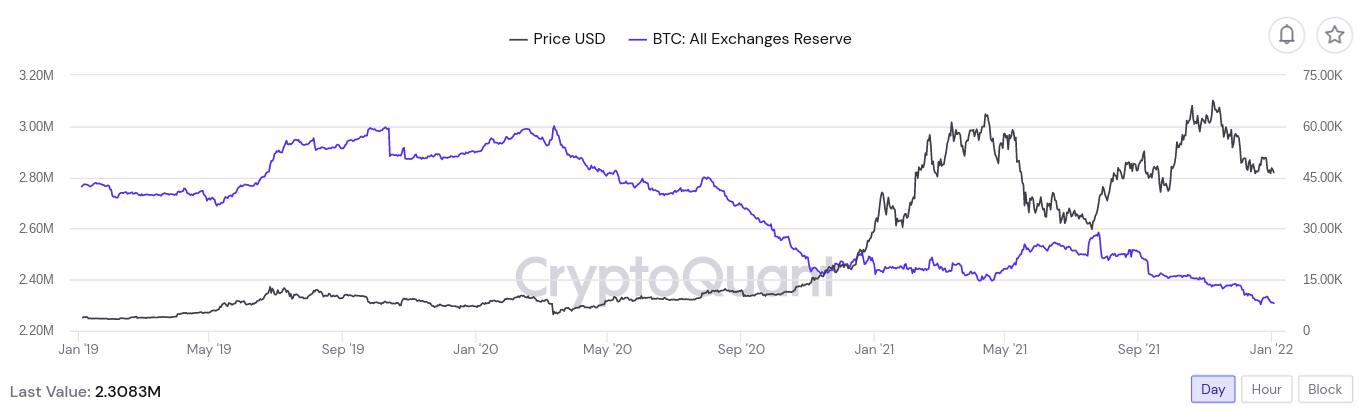

Bitcoin (BTC) exchange reserves are back around report lows as 2022 sparks renewed appetite amongst consumers.

Facts from on-chain analytics agency CryptoQuant demonstrates reserves across 21 exchanges at 2.308 million BTC as of Jan. 4.

Exchanges return to all round BTC harmony downtrend

Late December observed a macro low of 2.303 million BTC still left on exchanges’ textbooks, CryptoQuant recorded, just before a temporary uptick to 2.334 million.

As institutional entities return to the marketplace right after the holiday getaway period of time, however, the downtrend has resumed, this in line with anticipations that more substantial-volume customers would move in commencing in Q1.

Trade harmony information is a matter of some discussion this week. Diverse studies sources use different numbers of exchanges and wallets, resulting in details that is hardly equivalent.

CryptoQuant’s 21 exchanges, for case in point, contend with 18 monitored by Glassnode and 5 by CoinMetrics.

Đăng ký ngay: BingX – Nền tảng giao dịch tiền mã hóa hàng đầu.

A further resource, Cryptorank, put the harmony at just 1.3 million BTC on Xmas Eve.

Relying on the platforms bundled, the pattern might also be different, as some exchanges have witnessed an total reduction in their balance above the past month, whilst other individuals have noticed an maximize.

If you leave out exchanges it skews the final results. Leaving out eg. Huobi has a huge effects due to the fact of the China spot investing ban.https://t.co/knyoF702kW

— Root (@therationalroot) January 3, 2022

As Cointelegraph noted, this was the scenario with Huobi World-wide, which was obliged to deregister Chinese mainland people by the stop of 2021 in line with restrictions.

Bigger fish to run the demonstrate

In a dialogue with CryptoQuant previous week, analyst David Puell, creator of the effectively-known Puell Many indicator, in the meantime exposed his views on approaching industry participant actions.

Associated: New year, similar ‘extreme fear’ — 5 things to watch in Bitcoin this 7 days

The “relaxed” nature of Bitcoin in 2021 vs ., for instance, 2019, has held retail traders and their “FOMO” absent.

“I think this is lengthy-phrase balanced,” he said.

“The industry is generally likely to be owned by institutional players, especially in thirty day period-to-month price tag movements, with some gain-getting from early adopters but a substantially much more diminished function coming from retail players.”