A mix of technological, macroeconomic, and on-chain indicators issue towards a price rally in the Ethereum current market this quarter.

Rate Evaluation

Ethereum’s native token Ether (ETH) has plunged by more than 20% right after creating its file superior at close to $4,867 on Nov. 10, 2021. Even so, the sharp selling price pullback does not suggest ETH cannot go after a new file high in the next couple of months, as quite a few broadly-tracked technological, macroeconomic, and on-chain indicators advise.

One of these indicators envisions Ether’s cost achieving $5,000 in the very first quarter of 2022 whilst some others glimpse are poised to help the bullish bias.

ETH value painting falling wedge

Ether’s new price tag correction is painting a possible basic bullish reversal sample acknowledged as “falling wedge.”

In element, falling wedges begin huge at the top but contract as the price tag moves decrease. As a final result, the selling price action sorts a conical shape that developments decrease as the response highs and response lows converge. Traders notice a bullish bias only immediately after the price decisively breaks earlier mentioned the wedge’s resistance.

As a result, expectations continue being large that the ETH rate would break higher than its falling wedge resistance in the coming sessions. In performing so, it would rise by as much as the optimum length in between the wedge’s higher and decrease trendline when measured from the breakout point.

Pretty much unchanged…$ETH is going to $5k pic.twitter.com/11mAQiJxJS

— Kong Investing (@KongBTC) January 4, 2022

That approximately puts the price concentrate on for Ether at $5,000.

ETH deposits to exchanges fall

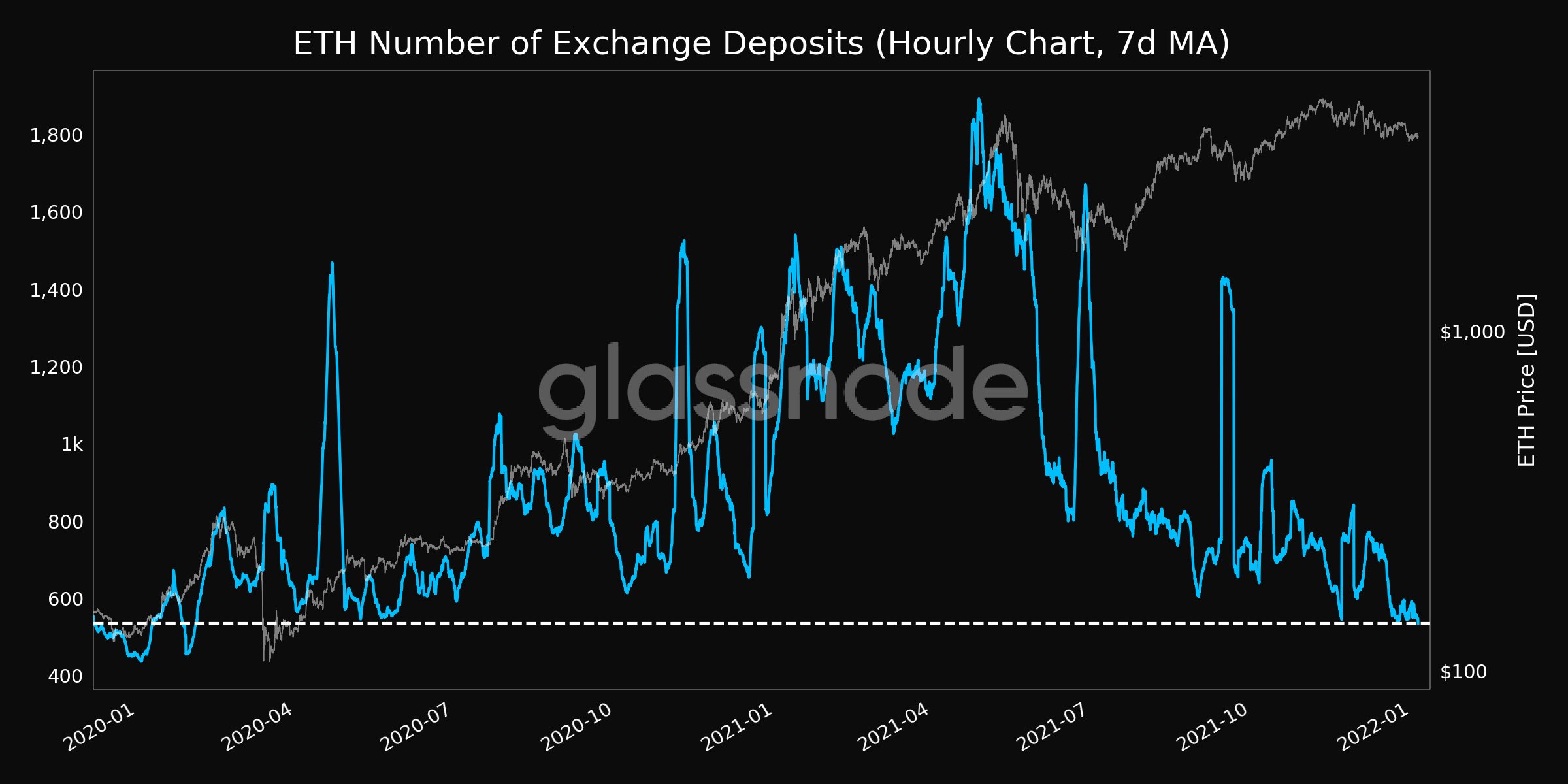

Traders ordinarily shift their tokens to exchanges when they intend to promote/trade them for either fiat, stablecoins, or other cryptocurrencies.

Usually, a better range of transactions built to crypto investing platforms demonstrates a higher promoting sentiment in the sector. Conversely, if the token transactions plunge, they show a solid keeping sentiment in the market.

Có thể bạn chưa biết, sàn giao dịch BingX đang có nhiều đặc quyền cho thành viên mới và thành viên VIP.

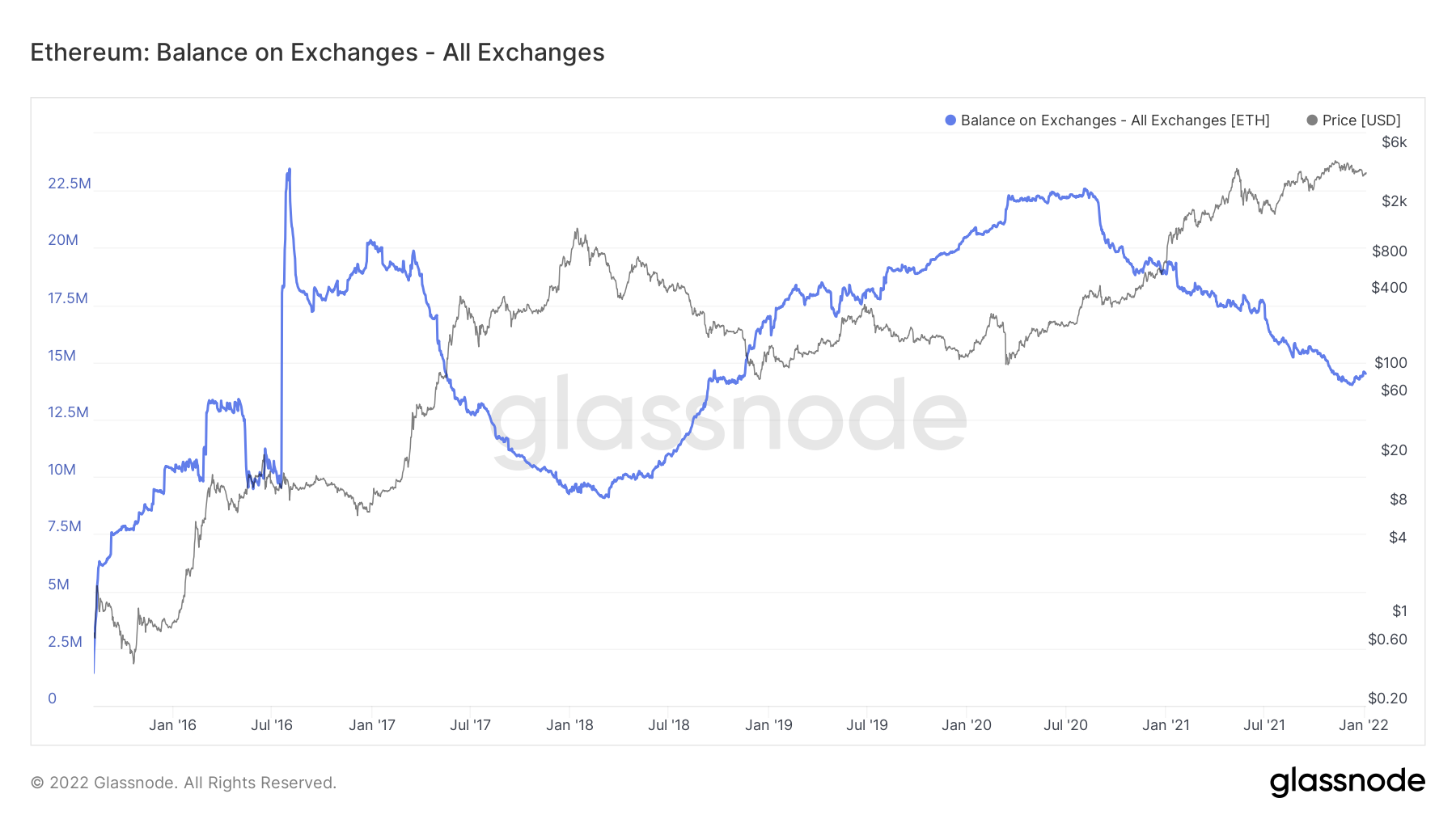

Info collected by blockchain analytics company Glassnode show that the range of on-chain Ether deposits to exchanges dropped to its 23-month minimal on Jan. 3.

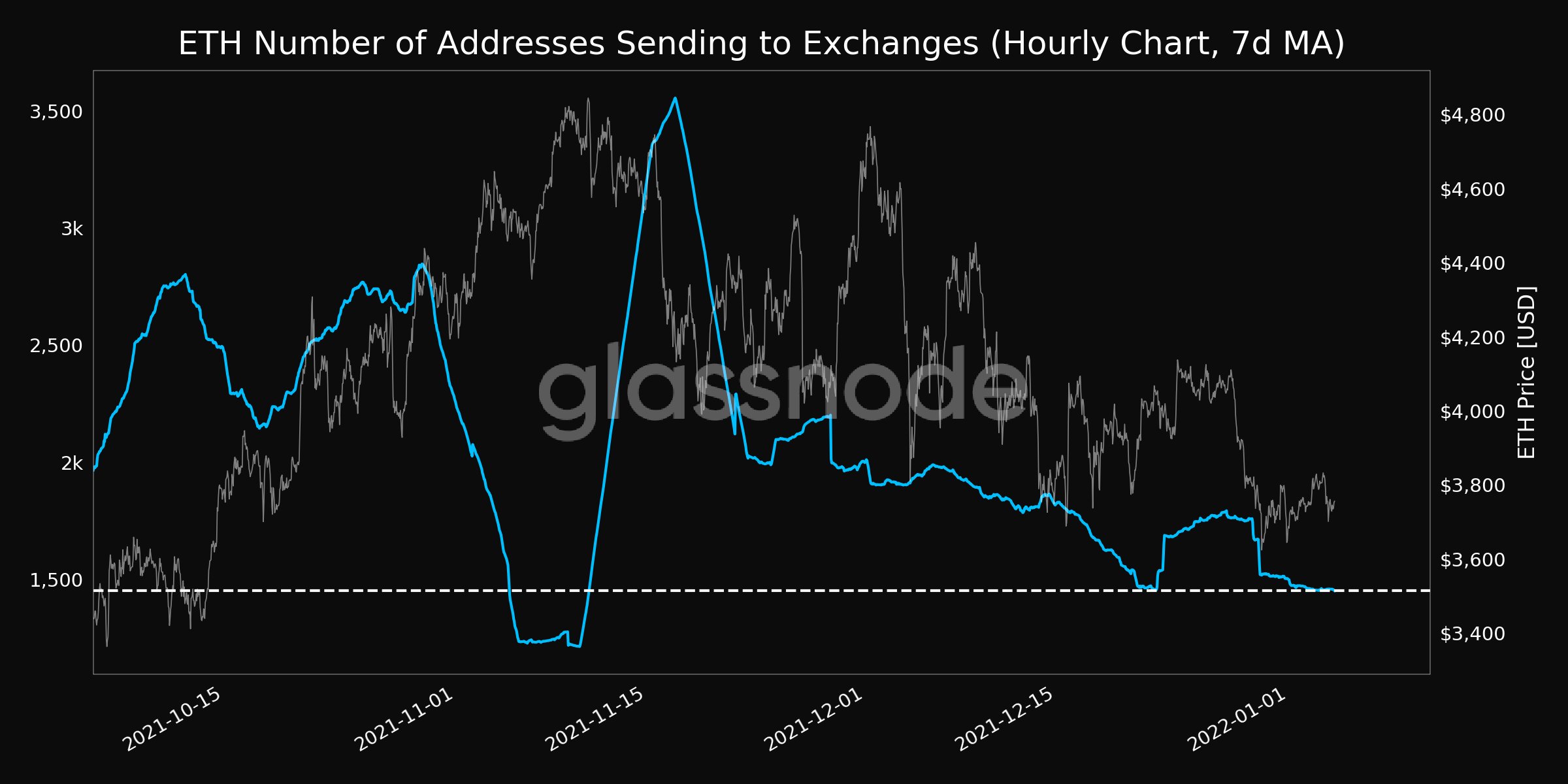

Additionally, a different Glassnode metric that tracks the variety of Ether addresses sending ETH to exchanges also claimed declines above the last 30 days, the exact period that noticed the ETH/USD price dropping virtually 11%.

In the meantime, the overall Ether balance across all the exchanges has been in a downtrend because Aug. 2020, suggesting that ETH buyers are in it for the extended haul as its price rose from practically $400 to a tiny over $3,800 in the exact same period of time.

Low-priced income below to remain?

Ether’s $1,000-furthermore plunge from Nov. 2021 to date majorly came in the wake of the Federal Reserve’s hawkish change.

The U.S. central financial institution resolved to speed up the unwinding of its $120 billion a month asset buy application, followed by 3 amount hikes in 2022 from its close to-zero levels, to stem rising inflation. Its unfastened financial policy was 1 of the major catalysts powering similar rate rallies throughout Ethereum, Bitcoin (BTC), and other crypto marketplaces.

But the Fed’s endeavours to tame inflation from its existing 6.8% level with a few fee hikes may well not impact Bitcoin and Ethereum costs in the prolonged operate. For example, Antoni Trenchev, managing companion of crypto financial institution Nexo believes that low-priced dollars is right here to continue to be.

“The No. 1 influencing aspect for Bitcoin and cryptocurrencies in 2022 is central financial institution plan,” he explained to Bloomberg. He added:

“Cheap funds is right here to keep which has big implications for crypto. The Fed does not have the belly or spine to face up to a 10%-20% collapse in the stock market place, along with an adverse response in the bond current market.”

Hungarian-born billionaire Thomas Peterffy also said that investors must allocate at the very least 2-3% of their internet portfolio to cryptocurrencies like BTC and ETH in case the fiat funds “goes to hell.”

Related: More billionaires turning to crypto on fiat inflation fears

Additionally, Bridgewater Associates founder Ray Dalio revealed that he has been keeping BTC and ETH in his portfolio versus the hazards of money devaluation led by larger inflation.